![[Energy Column] Liquid Immersion Cooling: A Hidden New Market in the Era of Global AI Data Centers Liquid immersion cooling: A hidden new market in the era of global AI data centers.](https://gscaltexmediahub.com/wp-content/uploads/2025/10/immersion-cooling-new-market-in-the-era-of-Global-AI-Data-Centers.jpg)

The recent explosive growth in artificial intelligence (AI) model training infrastructure has ushered in a new era for the data center industry. This demand has led to racks of high-density graphics processing units (GPUs), a demand that is difficult to handle with conventional air-cooling methods .

Asia Pacific: A New Growth Engine for the Immersion Cooling Market

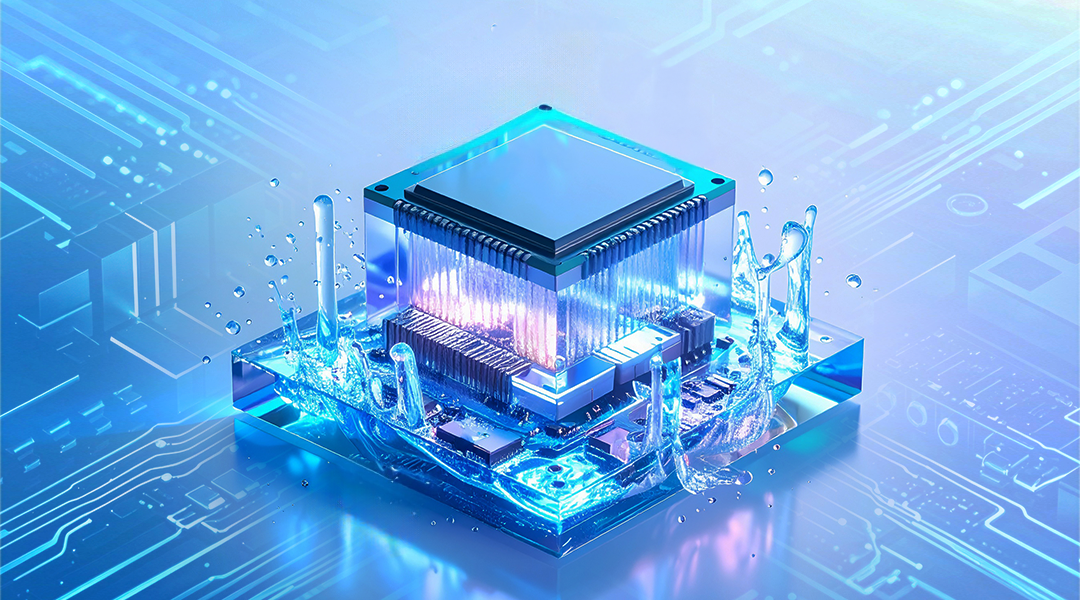

Addressing the smoke generation problem in high-density GPU racks and addressing energy efficiency challenges has emerged as key challenges for the data center industry. Among these, immersion cooling technology has recently been gaining attention. Immersion cooling involves directly immersing IT equipment in an insulating fluid or contacting the equipment with a cooling plate to rapidly dissipate high heat. It offers higher cooling efficiency and greater design flexibility than conventional methods.

![[Energy Column] Liquid Immersion Cooling: A Hidden New Market in the Era of Global AI Data Centers Global Market Insights' analysis of the liquid immersion market's size expansion.](https://gscaltexmediahub.com/wp-content/uploads/2025/10/immersion-cooling-market-rapid-growth-in-2034.jpg)

Recent analyses by market research firms predict rapid growth in the liquid cooling solutions market over the next several years. Global Market Insights projects that the global data center immersion cooling market will grow from approximately $1.6 billion in 2025 to approximately $7.2 billion in 2034, representing a compound annual growth rate of approximately 18.3%. Another report predicts that the global liquid immersion cooling market will grow at a compound annual growth rate of approximately 21.6%, from $5.38 billion in 2024 to $17.77 billion in 2030.

By region, North America remains the market’s center and a hub for AI data centers. This concentration of global big tech headquarters, including OpenAI, Google, and Microsoft, drives massive capital and GPU demand. North America is considered the region most active in the early commercialization and large-scale investment of liquid immersion cooling technology, holding approximately 44.8% of the liquid immersion cooling market as of last year.

The Asia-Pacific region is considered the fastest-growing market. The adoption of liquid immersion cooling technology is rapidly expanding due to a combination of factors, including the need to reduce electricity costs, space constraints, and tightening energy and environmental regulations. In particular, the high temperatures and humidity in countries like Korea, Japan, Singapore, and Australia significantly reduce the efficiency of air cooling. This is because cooling devices consume more energy in high-temperature and humidity environments, making it difficult to effectively control server heat generation. Furthermore, these countries are home to a high concentration of power-intensive industries such as AI, semiconductors, cloud computing, and financial data processing, resulting in very high power densities per rack. Consequently, conventional cooling methods struggle to control heat generation and maintain power efficiency. The combination of these environmental and industrial factors is driving a surge in demand for cooling efficiency-enhancing technologies in the Asia-Pacific region.

Recent analyses indicate that power consumption per rack in large AI data centers has increased by more than tenfold compared to previous generations. The proliferation of high-performance AI chips is fundamentally changing the design of cooling and power infrastructure. Consequently, liquid immersion cooling is moving beyond being a mere “alternative cooling technology” to becoming a core technology for AI infrastructure.

![[Energy Column] Liquid Immersion Cooling: A Hidden New Market in the Era of Global AI Data Centers GS Caltex launches 'Kixx Immersion Fluid S', Korea's first liquid immersion cooling coolant product, in 2023.](https://gscaltexmediahub.com/wp-content/uploads/2025/10/GScaltex-immersion-cooling-fluid-kixx-immersion-fluid-S.jpg)

Liquid immersion cooling: A new food source for Korean companies.

Amidst this global trend, Korean companies are also actively responding to the immersion cooling market. GS Caltex launched “Kixx Immersion Fluid S,” Korea’s first immersion cooling coolant product, in 2023. Since 2024, it has been expanding its field testing and industrial applications. The company has conducted technology verification by supplying coolant to Samsung SDS data centers and LG U+ Pyeongchon 2 Center.

Last September, GS Caltex, GS Engineering & Construction (GS E&C), and SDT signed a Memorandum of Understanding (MOU) to jointly develop liquid immersion cooling technology for data centers. Under the agreement, GS Caltex will supply cooling oil and technical solutions, GS E&C will design and build large-scale modular data centers, and SDT will supply and optimize liquid immersion cooling systems (such as AquaRack). In line with the expansion of the global AI data center market, Korean companies are actively seeking technological solutions and market entry opportunities in the areas of energy efficiency and thermal management.

GS Caltex’s liquid immersion cooling solutions are expanding beyond data centers to encompass a variety of applications requiring high-temperature management, including electric vehicles, batteries, and energy storage systems (ESS). This is seen as a strategic move to expand its business beyond data centers. While some argue that Korea’s data center facilities are smaller than those in the US or Europe, others believe Korea has significant growth potential, given its high-efficiency thermal management technology, domestic demand, and industrial ecosystem.

The widespread adoption of liquid immersion cooling technology is also transforming data center design. With cooling equipment and piping systems now occupying over 70% of a building’s floor space, cooling and power design are emerging as core elements of data center operation. This presents new opportunities for Korean companies in the areas of mechanical engineering, cooling equipment, and modular construction.

However, there are still challenges to overcome. The stability of liquid immersion cooling fluids, their compatibility with servers, and their cooling efficiency have not yet been fully validated at the large-scale cluster level. The higher initial equipment investment costs compared to air-cooling systems are also a concern.

Experts emphasize that for Korean companies to secure a competitive edge in the global liquid cooling market, strategic responses are necessary, including ▲securing international certification and standard compliance for cooling fluids and systems, ▲strengthening modular data center design and construction capabilities, and ▲expanding demand sources to industries other than data centers (batteries, ESS, and power infrastructure).

Article by Kim Ri-an, Korea Economic Daily reporter

※ This content was written with a contribution from Kim Ri-an, a reporter for the Korea Economic Daily.

- A structure that allows multiple servers or network equipment to be installed and operated by stacking them vertically on a metal frame of a certain standard . ↩︎